Your finances shouldn’t live in five apps and your memory.

Investments here, bank account there, pension somewhere else… TILT brings it together so you can see how your financial health evolves over time – without spreadsheets.

🔴 Without TILT

You “sort of” know where you stand. You jump between apps, try to remember what’s where, and end up with pieces of the puzzle – never the full number.

With TILT 🟢

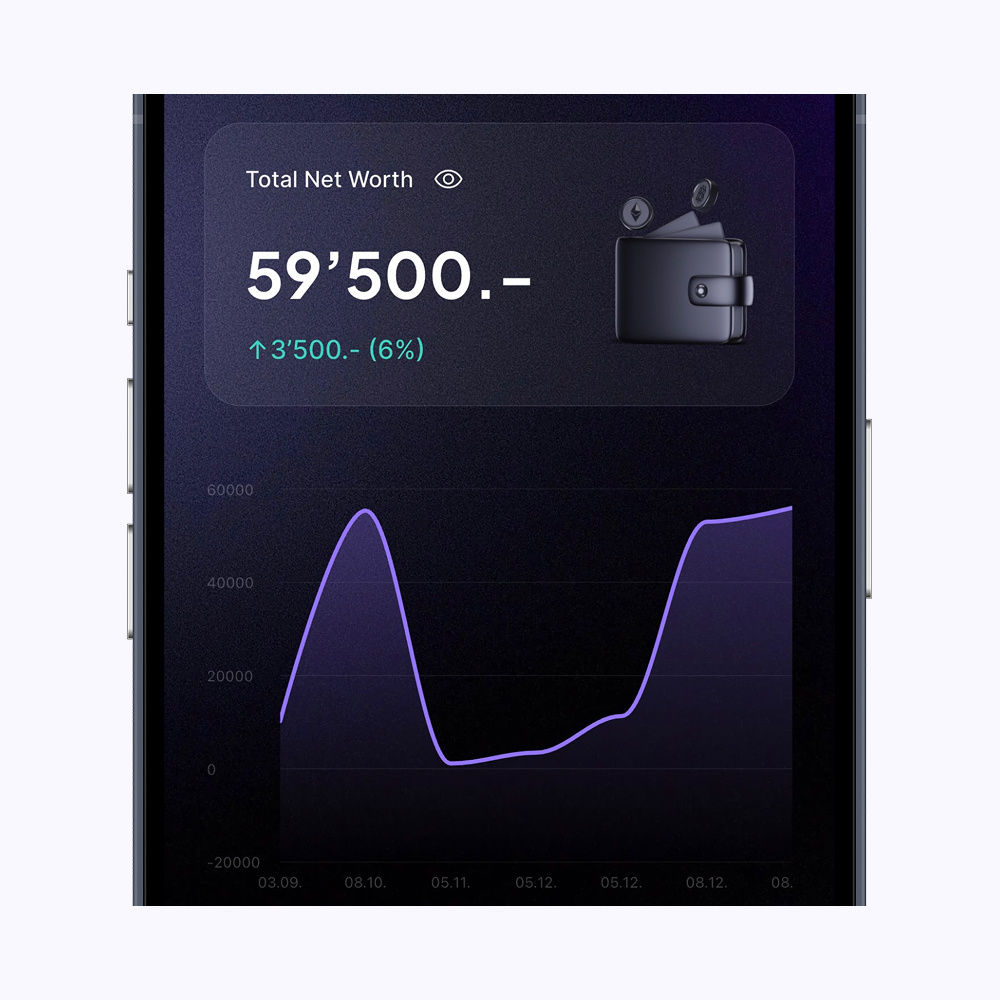

You see your total net worth at a glance. All your assets and liabilities in one place, a clear trend over time, and decisions based on facts instead of guesses.

You don’t need to track every coffee.

Most personal finance apps obsess over transactions and budgets.

TILT focuses on your net worth – the one number that tells you how close you are to life-changing decisions: taking a career break, buying a home, retiring earlier, or reaching financial freedom.

Track your net worth in 3 steps.

01

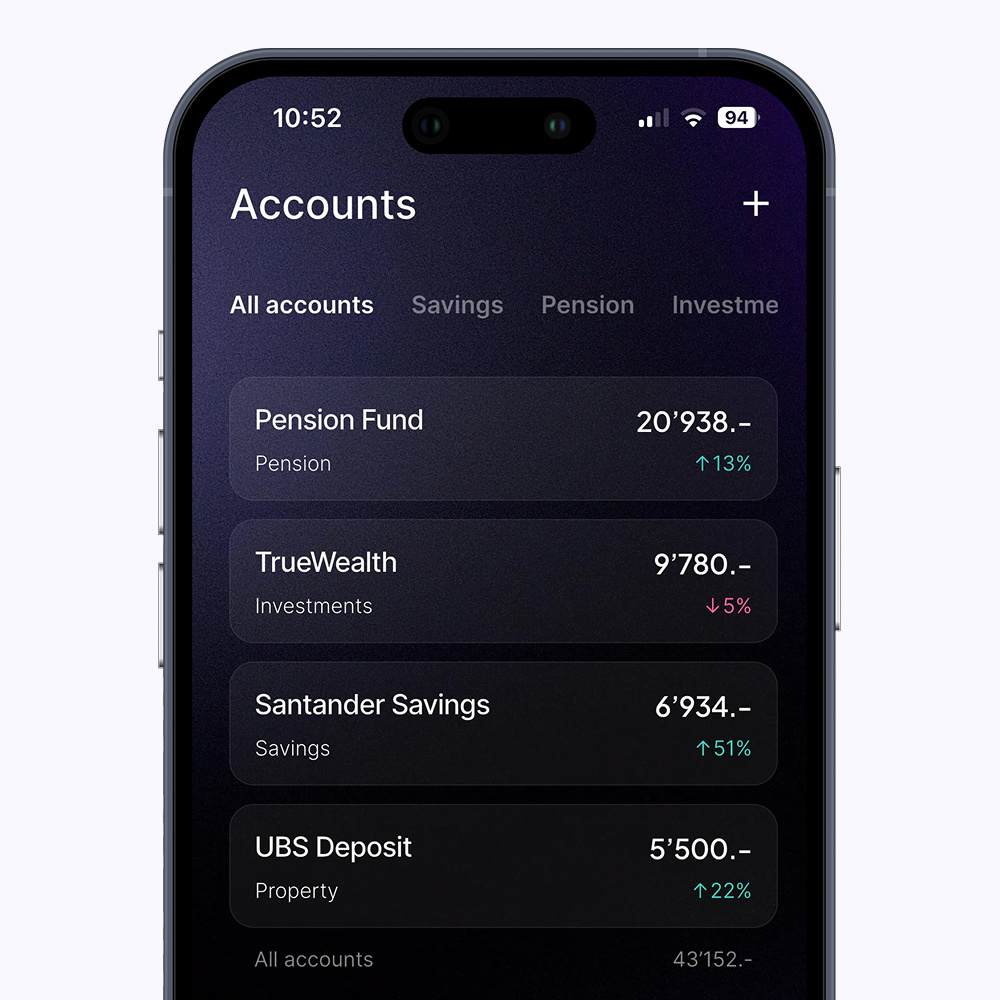

Add what you own & owe

Add accounts and assets in seconds: cash, bank accounts, investments, pension funds, crypto, property, loans. Just enter totals – no bank connection needed.

02

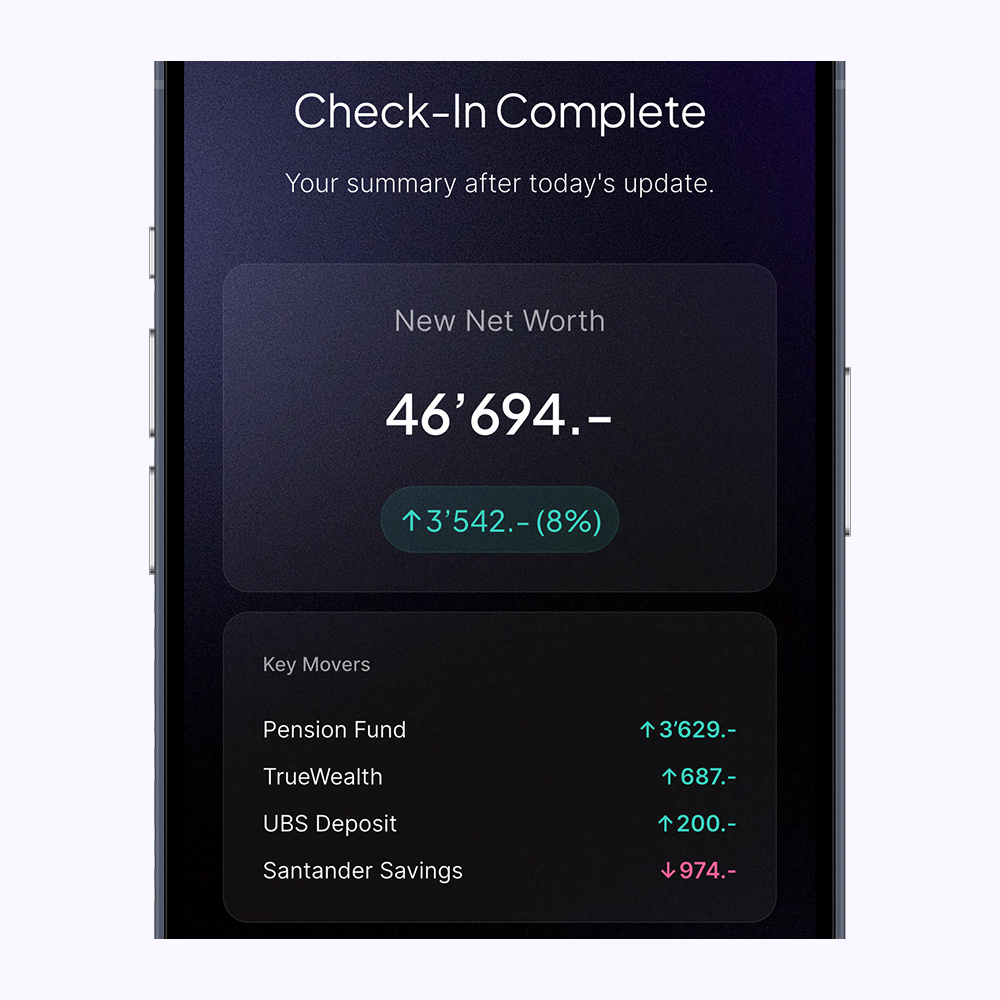

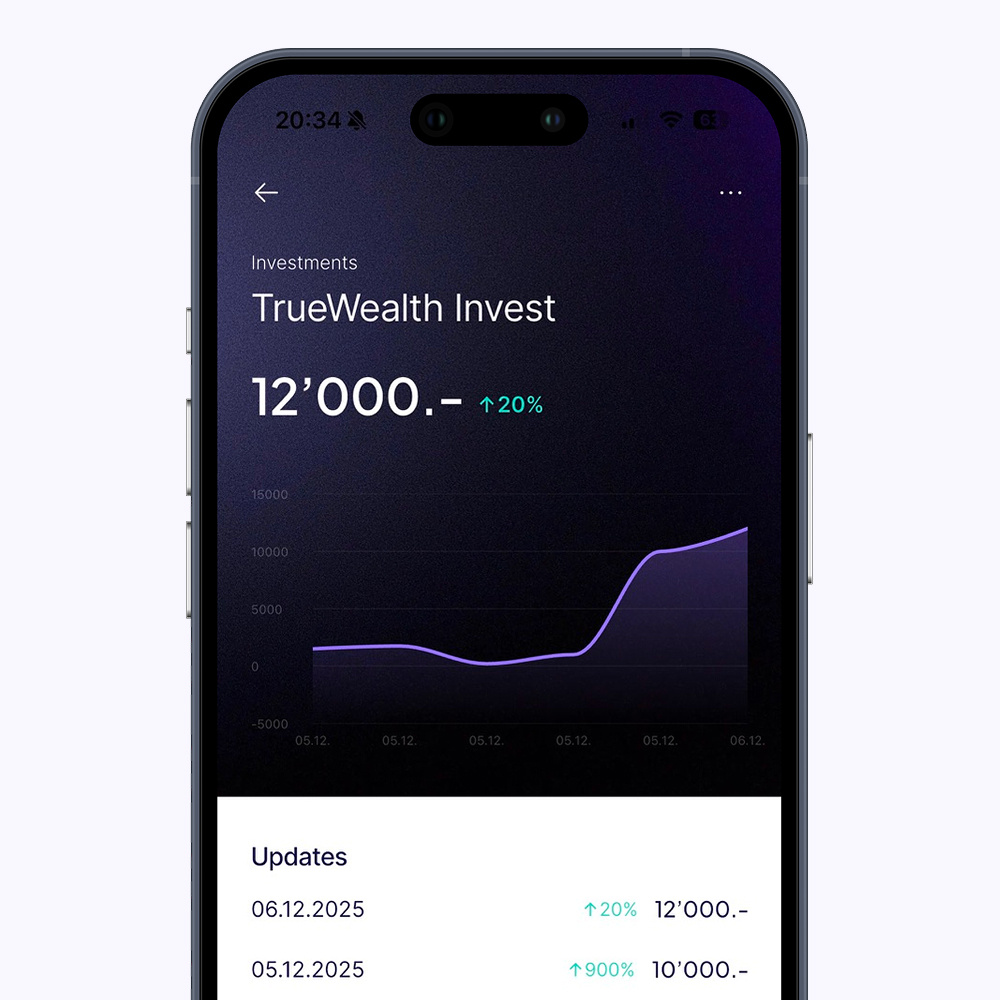

Do your check-ins

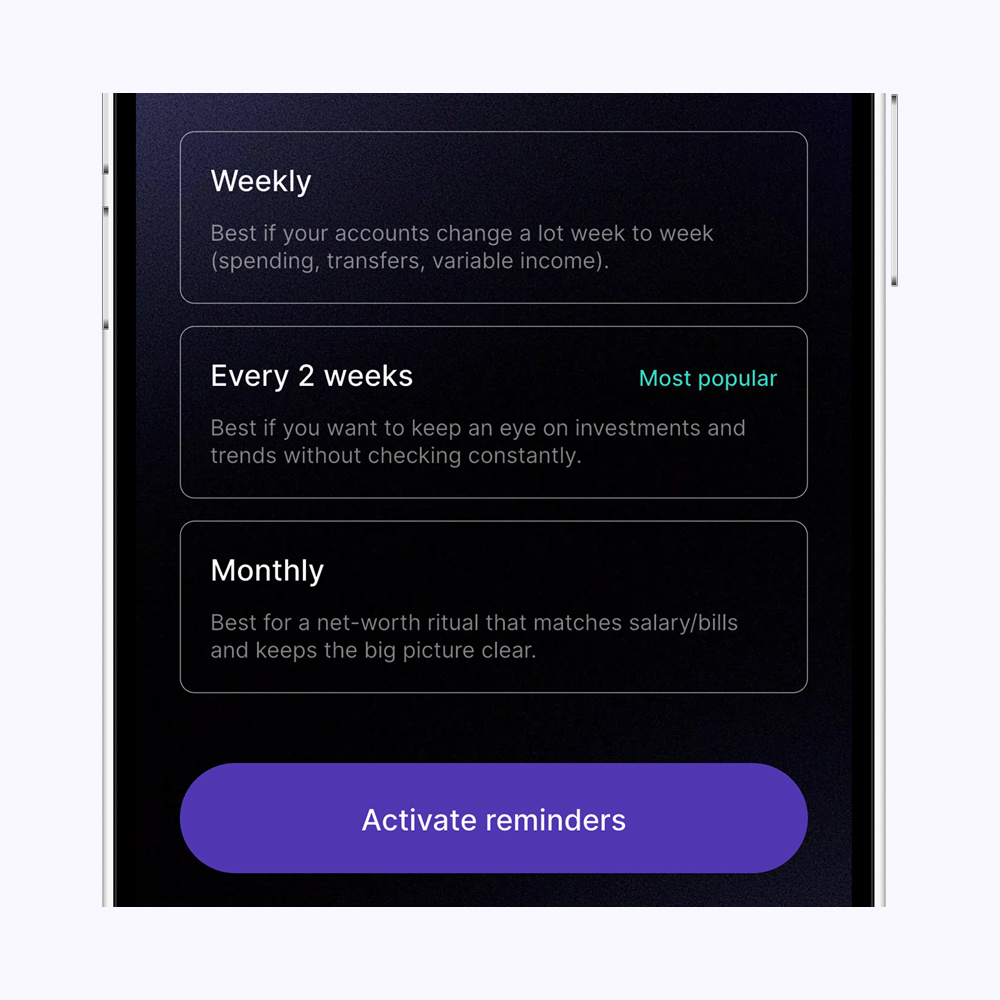

A calm 5-minute ritual. Update balances one by one, whenever you want (weekly, monthly). It’s like journaling – but for your money.

03

See your net worth update instantly

TILT updates your net worth timeline, totals, and allocation automatically – so you always know where you stand.

Awareness changes everything.

Manual tracking works because it makes you pay attention.

When your net worth is visible, you naturally spend with more intention, invest more consistently, and make smarter choices – without feeling like you’re “budgeting”.

A simple yet powerful wealth tracker you’ll actually use.

See your net worth and progress at a glance.

Understand your assets allocation.

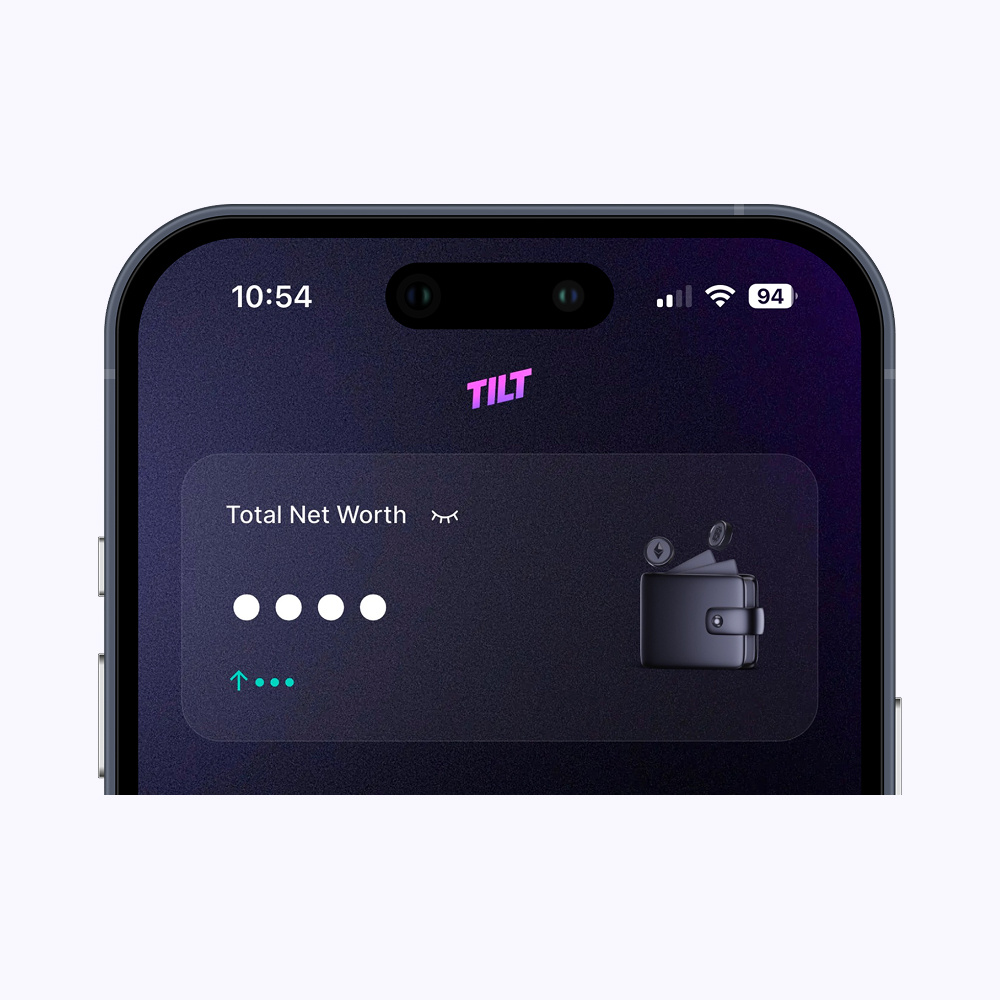

Hide all amounts instantly with Privacy Mode.

Get a clean summary after every update.

Keep all your accounts and assets in one place.

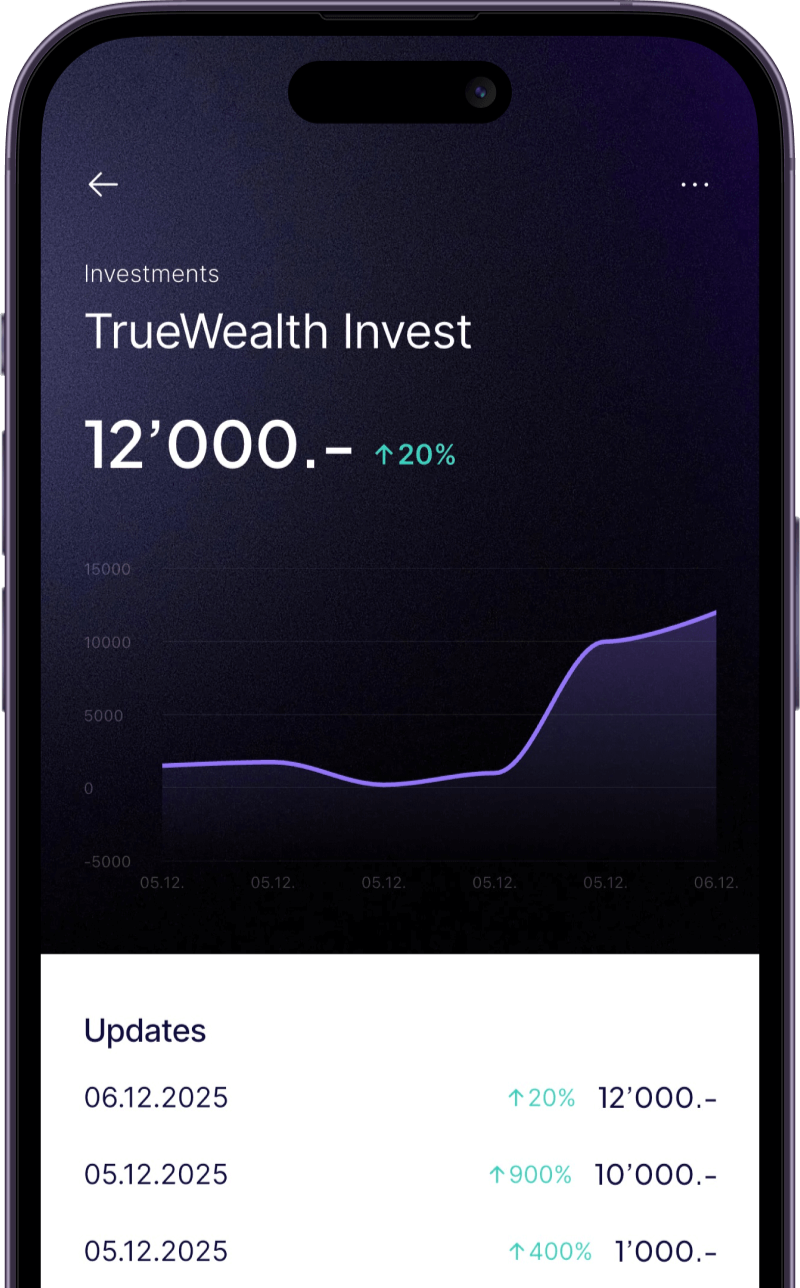

Track each account’s progression over time.

Stay consistent with gentle check-in reminders.

Track your net worth in CHF, EUR, or USD.

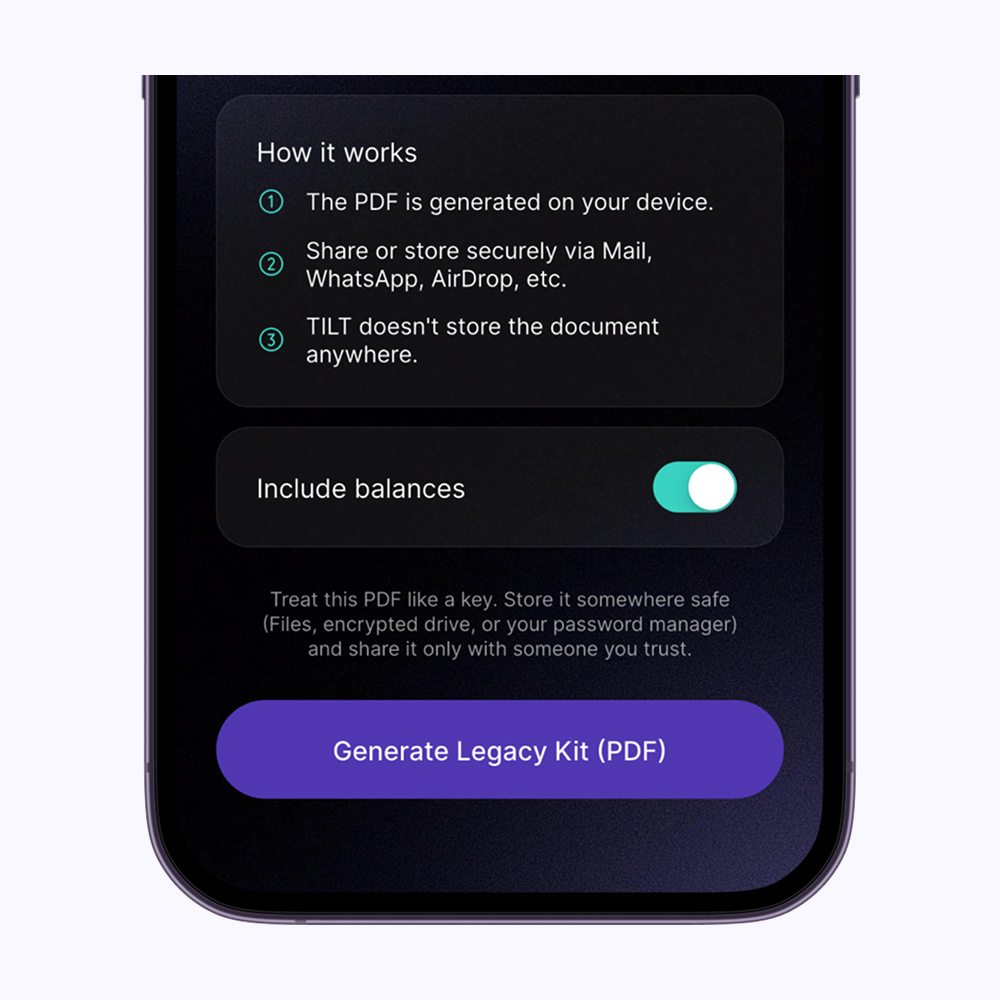

New Generate your Legacy Kit (PDF Export).

Private by design. Built in Switzerland.

No bank connection required. No data selling. No ads. Just a simple app to track what you own and owe – privately.

Hello, I’m Gautier.I built TILT for one reason: I wanted a simple way to see my net worth without spreadsheets or bank syncing.If your money is spread across accounts, investments, pensions, and loans, TILT helps you pull it together and track your progress over time – privately.

Ready to see your full financial picture?

Add your assets and debts once. Then do quick check-ins to stay aware and watch your net worth timeline evolve.